Cultural Alignment In Mergers and Acquisitions Is Crucial for Success

Values and cultural alignment in mergers and acquisitions only matter if you want the transaction to be successful. Otherwise, just close the deal and count that as a success. That’s been the history of mergers and acquisitions—where the deal professionals are paid at closing—and a large reason why 70 to 90 percent of deals fail to meet financial objectives.

Price Pritchett captured the perils of an ill-conceived or poorly planned merger in his poem Mergerized, from his acclaimed book, Making Mergers Work: A Guide to Managing Mergers and Acquisitions, which paints a picture of disillusionment, disappointment and devaluation; but your prospects can be better with due diligence around values and culture fit.

Failure to consider cultural alignment in mergers and acquisitions can be the kiss of death.

People tend to lump values and culture into one soft squishy subject that HR is supposed to deal with and that shows up occasionally in speeches and annual reviews. More and more, companies are learning that core values and company culture are at the heart of organizational effectiveness and are most critical when an organization is under stress. And, an acquisition is organizational stress on steroids.

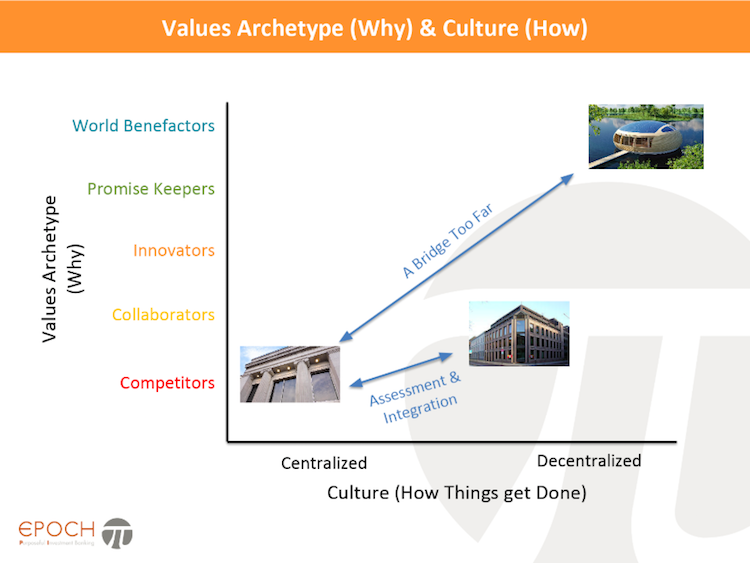

Let’s think about values and culture as kissing cousins. Organizational values speak to the why of a business and how it sees the world and its role in it. Culture on the other hand can best be thought about as “how we get things done (and especially when no one is looking)”.

Values go to the core of what people and a company believe concerning employees, customers, suppliers, the world and how they are to be treated. It speaks to what is important to the organization and its priorities. People argue to the death over issues of value. It’s that important, and you can characterize people and companies who hold certain values or sets of values into archetypes (labels). Culture on the other hand is a set of negotiable items.

Culture is usually categorized in an assessment into a handful of elements, but essentially it is the spoken or unspoken agreement on how we get things done. Are we centralized or decentralized? Our management is open or structured? Are we internally focused or externally oriented? To many people, there are clear rights and wrongs to culture, and there is evidence that some cultural behaviors are more effective than others, but actually, the most important factor is whether people within the group are aligned with the practiced culture. If you have strong alignment among the people, the organization knows how things have to be done. Maybe they could do better, but at least they are getting things done.

Management of the new, combined entity can negotiate what they want as an ideal culture--that which they strive toward. Not everyone will like it, they never do, but enough people will go along that the organization can function. With a thoughtful integration plan and culture assessments, you can find a workable agreement on the elements of culture and get on with the task of making the acquisition work.

It is a lot harder to bridge gaps in organizational values. Values run deep, they are how a company sees the world and they change very, very slowly if at all. If you don’t have reasonable congruity on values, you probably have two organization that will struggle to effectively work together. The larger the gap, the bigger the problem, and at some level, you will want to think about keeping the organizations separate and develop a long-term strategy for melding what are two very different organizations.

Financials are critical, but cultural alignment in mergers and acquisitions determine future success.

This is a long way of saying that you have to understand the values and culture profiles of both organizations if you want a deal to work. Know thyself is a starting point. Do you have clearly articulated corporate values and purpose? Have you done a culture assessment? Do you know how your organization stacks up against best practices? Then, have you chosen a counterparty with similar values? Do you know or have a sense of where there is good culture fit and where work is needed? With these additional insights, you have the information you need to structure the transaction and plan and manage the integration. Easy-peasy right? Well, maybe not easy, but it is definitely doable. Just follow the transaction workflow (and hire the investment bank) that brings these insights into the process.

EPOCH Pi is a Certified B Corp and investment bank that serves purpose-driven companies, companies that exist to provide both financial and social returns. Impact companies range from providers of clean technology and sustainable agriculture to old-line manufacturing companies that create meaningful work environments, have positive cultures, and treat suppliers and other stakeholders equitably. Our services range from capital formation for growth companies to generating liquidity for existing shareholders. In every case, one of our criteria is the alignment of our client’s purpose and vision with those of the financial stakeholders. At EPOCH Pi, we have developed a set of unique, proprietary assessment tools that facilitate cultural alignment in mergers and acquisitions. Learn more about our services here.