Q1 2021 Impact Company Insights and Business Trends

The first quarter of 2021 has seen the continuation of general business trends brought about by the COVID-19 pandemic. The U.S. Small Business Administration notes that remote work will persist, virtual services will be in high demand and e-commerce options will be sought after. The EPOCH Pi team has pulled together the following insights on how conscious companies — enterprises who seek to make an impact beyond profit on environmental, social or governance (ESG) issues — have performed in Q1 2021.

Impact companies continue to outperform the S&P 500 despite challenges from the pandemic.

Today’s great companies are fueled by passion and purpose, not solely profits. They are highly successful as a result of focusing on all stakeholders: customers, employees, investors, partners, communities, and the environment. This makes for a virtuous, reinforcing system of mutual benefit that creates shared value—much like a crew boat where all oarsmen are working in sync. The result is a more resilient company that is better able to negotiate challenges when others might be rowing in circles or working at cross purposes

2. More money is focused on Impact Investments than ever before, but the pandemic disrupted fundraising.

We have seen robust growth in private capital seeking impact investments over the past decade. Capital invested outpaced fundraising during the pandemic leading to a decline in dry powder across all private investment fund classes. More investors today understand the importance of mission, vision, and values to a company’s brand than at any other time in history, so we expect to see an increase in capital-seeking companies providing social/environmental as well as financial value over the remainder of the decade.

There are increasing signs more PE funds, and in particular, their LP investors, are beginning to track ESG metrics in earnest. A small, but growing minority of “traditional” funds are increasingly considering non-traditional sources of value creation such as the impact of ESG factors in their screening process, strategic decision-making, due diligence, performance and reporting as they focus on protecting and maximizing value.

3. Venture capital valuations are resilient in cyclical downturns due to the long investment horizon.

Early and later stage valuations continue their rise as angel to seed valuations remained relatively stable with a small decline.

4. In 2020, middle market private equity deal volume and exit multiples declined, but the market recovered in Q1 2021.

5. U.S. PE deals decreased in value and number of transactions across the board in 2020. The softness continued in Q1 of 2021.

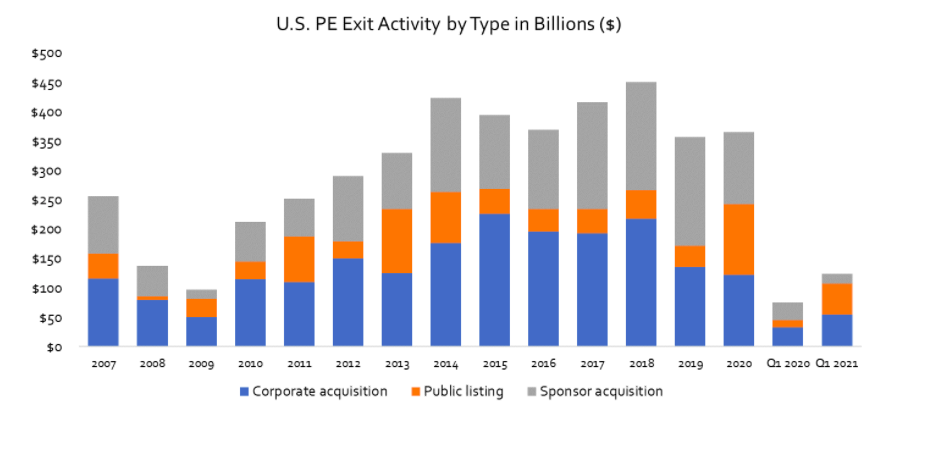

6. U.S. PE Exit Activity show the importance of the IPO market

At EPOCH Pi, we support the purpose economy by helping impact companies survive and thrive the corporate transaction. We are a purposeful investment bank that enhances our clients’ potential to do good by safeguarding their mission, vision, values and company culture. Contact us to learn more about how we help purpose-driven companies with traditional investment banking services such as capital raises, integrations, alternative structures and more.